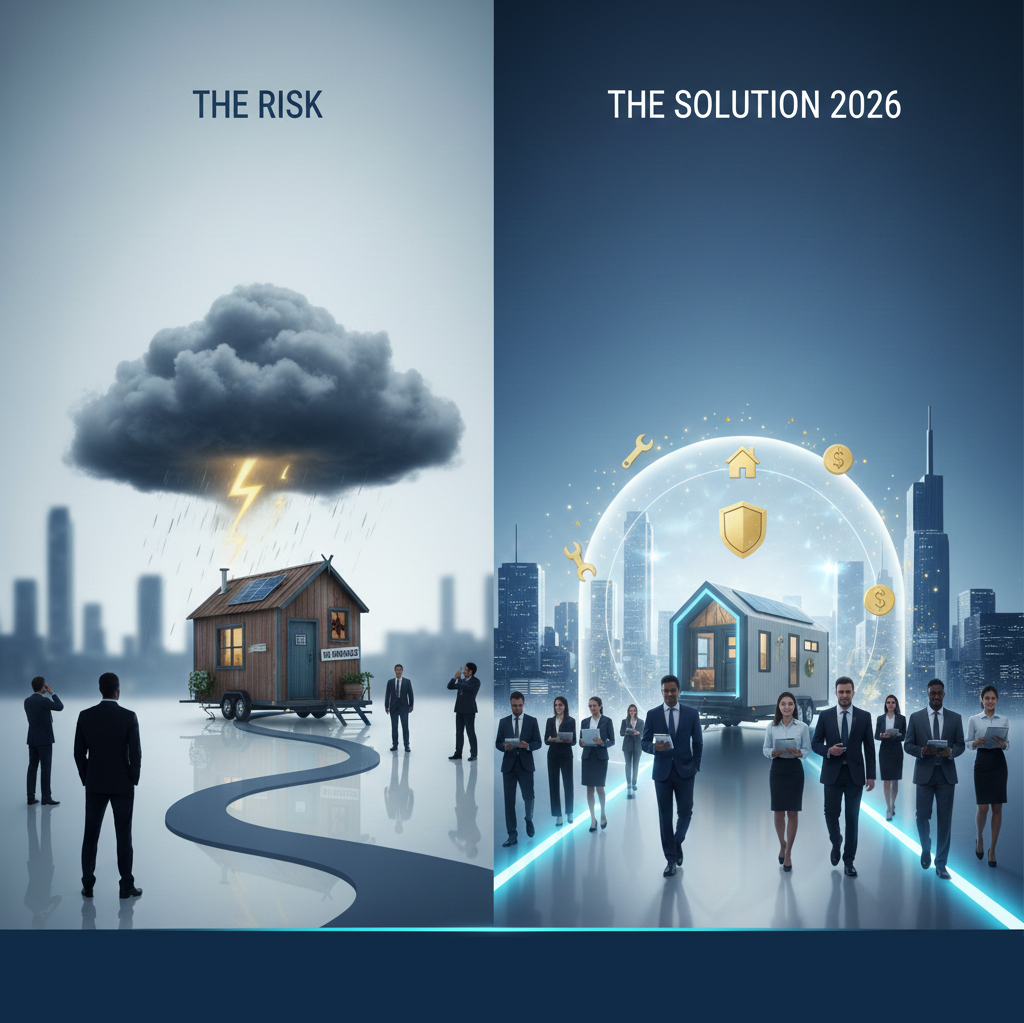

So, you’ve finally built or bought your dream home on wheels. It’s mobile, it’s cozy, and it’s yours. But there is a catch: Most traditional insurance companies don’t know what to do with it. Is it a vehicle? Is it a house? If you don’t get the right insurance, one road accident or a kitchen fire could wipe out your entire investment. Here is how to navigate the complex world of Tiny House on Wheels (THOW) insurance in 2026.

The Big Challenge: RV vs. Mobile Home Insurance

The reason tiny house insurance is tricky is that your home is “transient.”

- RV Insurance: If your tiny house is certified (like NOAH or RVIA), you can often insure it as a high-end RV. This covers you while driving, but may have limits on “full-time living.”

- Manufactured Home Insurance: This is for homes that stay in one place. If your wheels are just for occasional moves, this might be a better fit.

Leading Tiny House Insurance Companies (2026)

- Strategic Insurance (Tiny House Experts): They provide plans made especially for THOWs, including do-it-yourself construction.

- First and foremost: An excellent choice for people with professionally constructed tiny homes.

- Progressive (RV Division): Ideal if you travel a lot and your house is RVIA certified.

How to Lower Your Premiums

Insurance for a tiny house can range from $600 to $1,500 per year. To get the lower end of that:

- Get Certified: Homes built by certified manufacturers (like Tumbleweed) are much cheaper to insure than DIY builds.

- Safety First: Install smart smoke detectors and a high-end GPS tracker.

- Bundle: If you use the same company for your towing vehicle and your tiny house, you can save up to 15%.

Conclusion

The cost of a tiny house is high. You could lose everything in a single severe storm if you don’t have the proper insurance. Make sure you are truthful about whether you live there full-time or only on weekends by taking the time to obtain at least three quotes.

Amanda Thomas is a wellness researcher and a full-time digital nomad dedicated to human optimization. By blending data-driven biohacking with geographic arbitrage, they have mastered the art of living a high-performance lifestyle while traveling the globe. Amanda Thomas’s mission is to help remote workers achieve peak focus and longevity without burnout.