In 2026, financial freedom isn’t about how much you earn; it’s about how much you keep. Additionally, because of inflation and living costs, conventional budgeting has become a challenge. That is why the 50/30/20 Rule has become the gold standard for individuals, freelancers, and digital nomads worldwide.

Budget Calculator (50/30/20)

Whether you are earning in Dollars, Euro, or Indian rupees, this simple calculator-based plan ensures that no matter how much money you make, you are living well while taking care of the future.

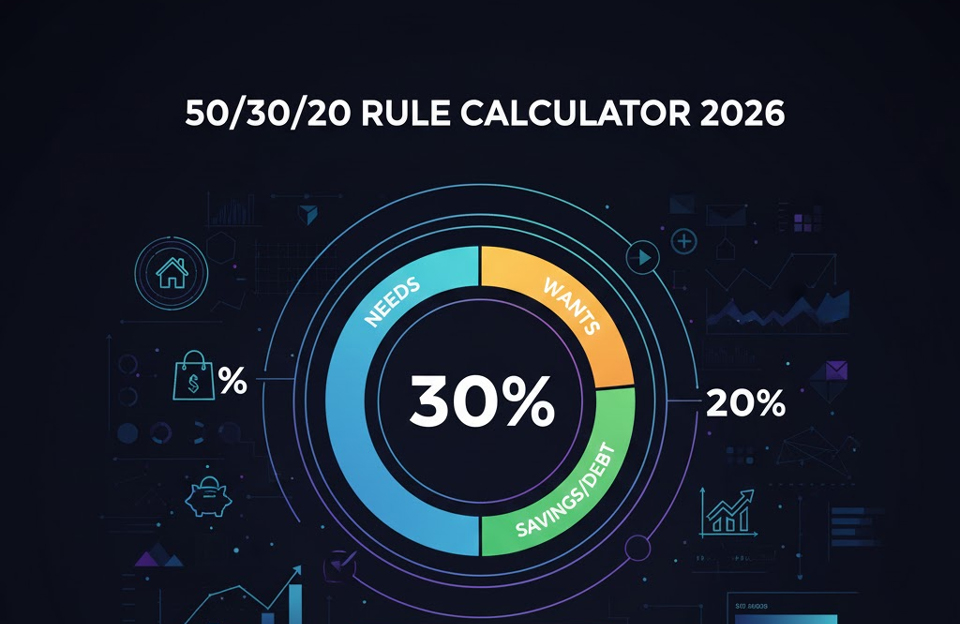

What is the 50/30/20 Rule?

Created by Senator Elizabeth Warren, this rule simplifies your after-tax income into three distinct buckets:

- 50% for Needs: Essential expenses like rent, groceries, utilities, and insurance.2

- 30% for Wants: Lifestyle choices like dining out, travel, and that Apple AirPods Pro 3 upgrade.

- 20% for Savings & Debt: Emergency funds, retirement contributions, and paying off high-interest loans.

How to Use Our 50/30/20 Calculator

Using a manual spreadsheet is outdated. Follow these steps on our Calculators Page:

- Enter your total monthly income (after taxes).

- The calculator automatically splits your income.

- If you are aggressively repaying debt, adjust sliders as required.

2026 Pro-Hacks for Your Budget

- Automate the 20%: Set up a direct transfer to your savings account the day you get paid.

- The “Needs” Audit: In 2026, many subscriptions (like AI tools) sneak into “Needs.” Re-evaluate them!

If you use tech for work, check our Tax Deductions for Freelancers 2026 to move some of your “Wants” into tax-deductible business expenses.

Is the 50/30/20 Rule Still Realistic in 2026?

Many critics argue that in high-cost cities, 50% isn’t enough for rent. If your “Needs” hit 70%, don’t panic. Use the calculator to identify where you can cut from the 30% (Wants) to protect your 20% (Savings).

Improving your productivity with a High-Income Skill-Stack is the fastest way to increase your total income so that your “Needs” percentage naturally drops.

Final Verdict: Your Future Self Will Thank You

Financial stress is the leading cause of burnout in 2026. By using the 50/30/20 Rule Calculator, you remove the emotional guesswork from your spending. You gain the permission to enjoy your 30% today because you know your 20% is building your freedom for tomorrow.